Law Firm Joint Ventures™

Let's Turn 1 + 1 = ∞ ROI

By Leveraging The Power Of Law, AI, And Philanthropy.

Welcome To LawyerX.

Hello - I’m Sid Peddinti.

My journey and experiences in the legal realm have been highly unconventional and out-of-the-box.

At 18 - I started a bakery that turn into a million-dollar business over the next few years.

At 22 - The banks forced me into a bankruptcy, pierced my entities, and liquidated all my assets.

Despite having attorneys to protect my assets, accountants to save money, and financial advisors to grow my wealth - everything crumbled under pressure.

WHY and HOW?

Because none of them operated from the same playbook and did not even know each other

They were brilliant on their own - but completely misaligned and operating in silos

So I devoted my life to researching, implementing, and teaching the strategies that can help people build risk-free, recession-proof businesses and estates.

I focused on researching the tech billionaires - how were they launching and investing without risk?

How are the wealthiest families preserving wealth across generations and protecting against internal and external threats?

What were the secrets that everyday entrepreneurs were NOT exposed to that can change the trajectory of their life?

This quest led me to pursue:

Bankruptcy, tax, and restructuring certifications in Toronto

Law school in London and focused on International Business & Tax Law

An LLM in Business & Tax Law from Los Angeles

I've also taken a plethora of AI, blockchain, accounting, real estate, insurance, and investment courses, programs, and trainings over the years to learn and uncover the secrets of the wealthy.

I fell in love with building online businesses and launched my first virtual firm in 2008, licensing it to professionals across Canada.

I managed the bankruptcy firm in Toronto while attending and completing law school in the UK and then the LLM in Los Angeles = 100% virtual (with Skype)

Since then, I’ve represented thousands of startups, built AI-powered platforms, and used emerging tech to scale law and launch ventures globally.

MY JOURNEY THROUGH SEVERAL LEGAL NICHES AND WORKING WITH THOUSANDS OF BUSINESSES REVEALED A FEW PATTERNS:

The same gaps in communication between law, tax, and financial experts (that collapsed my business) still exists - experts are still operating in silos

Proactive legal and tax strategy was the missing component that can solve that problem - lawyers, accountants, and financial advisors do not offer proactive law & tax strategy

The wealthy operate in a "family office" setting - where law, tax, and finance decides were made under one umbrella and most experts are not offering that

Do you offer a holistic and comprehensive family office setting experience that bridges these gaps in communication?

In 2020, COVID hit and business, as we know it, changed forever.

The online education industry boomed like never before - and still is still expanding every year

Virtual law firms are now mainstream and more accepted

Artificial Intelligence is also mainstream and consumer-friendly

And scammers have started to offer legal work in all sorts of industries as well:

Immigration scams

Bankruptcy law scams

Estate and tax planning scams

Trademark and patent scams

And I'm sure YOU have come across many scams in your industry as well

It was time to share the power of "THE DOUBLE BOTTOM-LINE APPROACH", the strategy used by fortune 500s and billionaires to help people bypass the scams, regain control of their wealth, and thrive on all fronts.

One bottom-line focuses on advancing PROFITS through the innovative integration of nonprofits and foundations that advance education and innovation

One bottom-line focuses on advancing HUMANITY through the integration of nonprofits and foundations that support other public causes and nonprofits

I call this philanthropic tax integration BENT LAW™: BUSINESS, ESTATE, NONPROFIT, AND TAX STRATEGY™ - fused, aligned, and combined and delivered in a Mini Family Office™ setting - where the LAWYER's role transcend from drafting and filing to LAW, TAX, AND LEGACY ARCHITECTURE.

As lawyers, we are strategists, architects, problem-solvers, issue-spotter, teachers of the law, and the protectors of consumers!

TAX LAW - specifically incorporate tax-exempt structures - has allowed YOU to wear all those hats - seamlessly. Tax law is:

Stimulating and interesting

Extremely relatable and applicable

Needed by EVERY SINGLE PERSON you will meet in your life - clients, partners, peers, friends, strangers, etc.

Something that allows you to become the "most interesting person" in every single room and meeting

An area of law that can be applied across all 50 states - as lawyers, you are ALREADY QUALIFIED to work on tax matters with the IRS (if you ever get into that stream)

It is extremely flexible and virtual and can be easily BOLTED-ON to your existing practice area - every dollar is taxed 20-50% - so it's inevitable in every transaction

And positions you as the goto law and tax architect that your clients and their advisors will be speaking with and cross-checking ideas with

The strategic integration of NONPROFITS AND FOUNDATIONS™ unlocks a plethora of business, estate, and tax benefits that position you as the architect of legacies for your clients. These are also benefits and advantages that you can incorporate in your own business or life if you have not done so:

Reduction in income taxes every year: 30-60% by strategically donating to the nonprofits or foundations

Reduction or elimination of capital gains taxes from liquidation events through strategic gifting

Reduction or bypassing gift, estate, generation-skipping-tax, trust taxes, and step-up rules on trusts

Elimination or bypassing probate rules on highly appreciated assets and legacy investments

Reduction of personal risk related to teaching the law, engaging with leads, or conducting investments

Unlocking hundreds of thousands a year in corporate and government grants and charitable donations to teach the law and advance education

Leveraging the goodwill, trust, credibility, and authority from transforming into an educator, innovator, philanthropist, and impact investor to unlock all sorts of business and investment benefits - while using your "wealth and intellect" to empower society...

It's a formula that's created with the "GOOD FOR BUSINESS AND GOOD FOR HUMANITY" model. Hence - double bottom line.

And it's not new - the Charitable Tax Deduction section has been around since 1917 - it's a century-old concept - but not really talked about much, is it?

This is the formula that I've started sharing across various platforms and in diverse formats since COVID.

I've structured my TEDx Talk on this topic

I've written articles and blogs in several publications like Forbes, Entrepreneur, Thrive, CEO World, etc.

I have spoken across 200+ stages, masterminds, and podcasts sharing the power of strategic philanthropy.

Since then, I've worked with entrepreneurs in 100+ niches and have launched over 350 educational nonprofits (mini-universities) that has been awarded with $50+ million in corporate grants to advance education in various industries. I've trained over 1,000 non-lawyers to share this formula and refer business to my firm -but ran into "quality control" issues along the way.

That's why I created LawyerX - a joint venture with LAW FIRM OWNERS - who are ready to use these strategies to unlock a nationwide, virtual, and lucrative practice - high-end law and tax restructuring by partnering with us. We've got the tech, the virtual tax law firms in a box ready to be bolted-on, and a range of services that you can take to your marketplace to stand out from competitors. There's a good chance you're one of the few who will be offering these strategies in your space.

I invite you to check out the resources I've put together below, the various ways in which we can JOINT VENTURE and advance the law, and leverage nonprofit grant funding options, and the tax benefits of foundations to teach the law, fight scammers in your niche, and trade our insights and discoveries with the help of AI.

If that resonates with you - I'd love to chat and see what we can build and do together.

Hope to chat soon,

Sid Peddinti

BA, BIA, LLB/JD, LLM

Hello - I’m Sid Peddinti.

My journey and experiences in the legal realm have been highly unconventional and out-of-the-box.

I ventured into law after facing a million-dollar business bankruptcy and losing all my assets when the banks pierced my entities in 2005.

Despite having attorneys to protect my assets, accountants to save money, and financial advisors to grow my wealth - everything crumbled under pressure.

WHY and HOW?

Because none of them operated from the same playbook

The gaps in communication and strategy destroyed my dreams

They were brilliant on their own - but completely misaligned from a holistic perspective

So I devoted my life to researching, implementing, and teaching the strategies that can help people build risk-free, recession-proof businesses and estates.

I focused on researching the tech billionaires - how were they launching and investing without risk?

How are the wealthiest families preserving wealth across generations and protecting against internal and external threats?

What were the secrets that everyday entrepreneurs were NOT exposed to that can change the trajectory of their life?

This quest led me to pursue:

Bankruptcy, tax, and restructuring certifications in Toronto

Law school in London and focused on International Business & Tax Law

An LLM in Business & Tax Law from Los Angeles

I've also taken a plethora of AI, blockchain, accounting, real estate, insurance, and investment courses, programs, and trainings over the years to learn and uncover the secrets of the wealthy.

I fell in love with building online businesses and launched my first virtual law firm in 2008, licensing it to professionals across Canada.

While earning my law degrees in the UK and U.S., I built joint ventures using Skype and PayPal, then opened a tech incubator in Santa Monica in 2013.

Since then, I’ve represented thousands of startups, built AI-powered platforms, and used emerging tech to scale law and launch ventures globally.

MY JOURNEY THROUGH SEVERAL LEGAL NICHES AND WORKING WITH THOUSANDS OF BUSINESSES REVEALED A FEW PATTERNS:

The same gaps in communication between law, tax, and financial experts (that collapsed my business) still exists - experts are still operating in silos

Proactive legal and tax strategy was the missing component that can solve that problem - lawyers, accountants, and financial advisors do not offer proactive law & tax strategy

The wealthy operate in a "family office" setting - where law, tax, and finance decides were made under one umbrella and most experts are not offering that

Do you offer a holistic and comprehensive family office setting experience that bridges these gaps in communication?

In 2020, COVID hit and business, as we know it, changed forever.

The online education industry boomed like never before - and still is still expanding every year

Virtual law firms are now mainstream and more accepted

Artificial Intelligence is also mainstream and consumer-friendly

And scammers have started to offer legal work in all sorts of industries as well:

Immigration scams

Bankruptcy law scams

Estate and tax planning scams

Trademark and patent scams

And I'm sure YOU have come across many scams in your industry as well

It was time to share the power of "THE DOUBLE BOTTOM-LINE APPROACH", the strategy used by fortune 500s and billionaires to help people bypass the scams, regain control of their wealth, and thrive on all fronts.

One bottom-line focuses on advancing PROFITS through the innovative integration of nonprofits and foundations that advance education and innovation

One bottom-line focuses on advancing HUMANITY through the integration of nonprofits and foundations that support other public causes and nonprofits

I call this philanthropic tax integration BENT LAW™: BUSINESS, ESTATE, NONPROFIT, AND TAX STRATEGY™ - fused, aligned, and combined and delivered in a Mini Family Office™ setting - where the LAWYER's role transcend from drafting and filing to LAW, TAX, AND LEGACY ARCHITECTURE.

As lawyers, we are strategists, architects, problem-solvers, issue-spotter, teachers of the law, and the protectors of consumers!

TAX LAW - specifically incorporate tax-exempt structures - has allowed YOU to wear all those hats - seamlessly. Tax law is:

Stimulating and interesting

Extremely relatable and applicable

Needed by EVERY SINGLE PERSON you will meet in your life - clients, partners, peers, friends, strangers, etc.

Something that allows you to become the "most interesting person" in every single room and meeting

An area of law that can be applied across all 50 states - as lawyers, you are ALREADY QUALIFIED to work on tax matters with the IRS (if you ever get into that stream)

It is extremely flexible and virtual and can be easily BOLTED-ON to your existing practice area - every dollar is taxed 20-50% - so it's inevitable in every transaction

And positions you as the goto law and tax architect that your clients and their advisors will be speaking with and cross-checking ideas with

The strategic integration of NONPROFITS AND FOUNDATIONS™ unlocks a plethora of business, estate, and tax benefits that position you as the architect of legacies for your clients. These are also benefits and advantages that you can incorporate in your own business or life if you have not done so:

Reduction in income taxes every year: 30-60% by strategically donating to the nonprofits or foundations

Reduction or elimination of capital gains taxes from liquidation events through strategic gifting

Reduction or bypassing gift, estate, generation-skipping-tax, trust taxes, and step-up rules on trusts

Elimination or bypassing probate rules on highly appreciated assets and legacy investments

Reduction of personal risk related to teaching the law, engaging with leads, or conducting investments

Unlocking hundreds of thousands a year in corporate and government grants and charitable donations to teach the law and advance education

Leveraging the goodwill, trust, credibility, and authority from transforming into an educator, innovator, philanthropist, and impact investor to unlock all sorts of business and investment benefits - while using your "wealth and intellect" to empower society...

It's a formula that's created with the "GOOD FOR BUSINESS AND GOOD FOR HUMANITY" model. Hence - double bottom line.

And it's not new - the Charitable Tax Deduction section has been around since 1917 - it's a century-old concept - but not really talked about much, is it?

This is the formula that I've started sharing across various platforms and in diverse formats since COVID.

I've structured my TEDx Talk on this topic

I've written articles and blogs in several publications like Forbes, Entrepreneur, Thrive, CEO World, etc.

I have spoken across 200+ stages, masterminds, and podcasts sharing the power of strategic philanthropy.

Since then, I've worked with entrepreneurs in 100+ niches and have launched over 350 educational nonprofits (mini-universities) that has been awarded with $50+ million in corporate grants to advance education in various industries. I've trained over 1,000 non-lawyers to share this formula and refer business to my firm -but ran into "quality control" issues along the way.

That's why I created LawyerX - a joint venture with LAW FIRM OWNERS - who are ready to use these strategies to unlock a nationwide, virtual, and lucrative practice - high-end law and tax restructuring by partnering with us. We've got the tech, the virtual tax law firms in a box ready to be bolted-on, and a range of services that you can take to your marketplace to stand out from competitors. There's a good chance you're one of the few who will be offering these strategies in your space.

I invite you to check out the resources I've put together below, the various ways in which we can JOINT VENTURE and advance the law, and leverage nonprofit grant funding options, and the tax benefits of foundations to teach the law, fight scammers in your niche, and trade our insights and discoveries with the help of AI.

If that resonates with you - I'd love to chat and see what we can build and do together.

Hope to chat soon,

Sid Peddinti

BA, BIA, LLB/JD, LLM

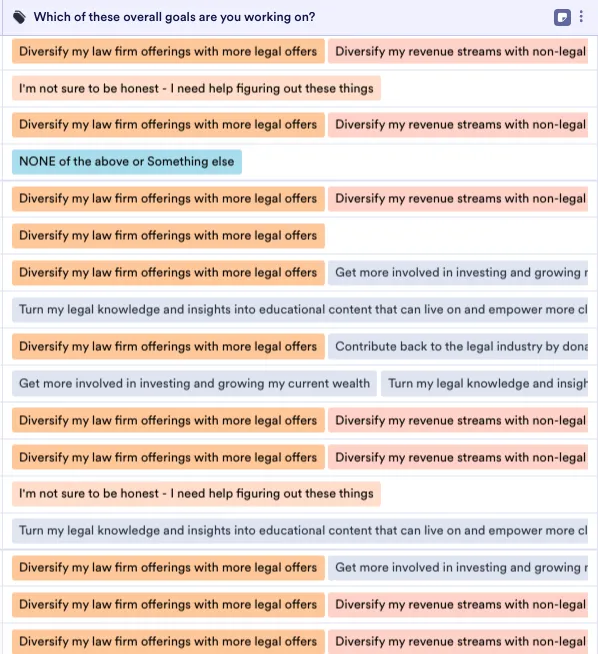

WHY SHOULD LAW FIRM OWNERS EXPLORE JOINT VENTURES?

Most industries collaborate - coaches, marketers, financial advisors.

But lawyers? We’re still trying to do it all alone.

Running ads. Hiring teams. Testing new offers.

All by ourselves. And when it doesn’t work, we start over—alone.

Law can be rewarding, but it’s also isolating.

It’s time to change that.

You’ve already built trust in your niche - immigration, family, DUI, personal injury, or business law.

But chances are, you haven’t yet tapped into the power of combining law, tech, and philanthropy.

We bring advanced expertise in BENT Law™ - Business, Estate, Nonprofit, Tax - plus access to millions in grant funding and AI scientists on my team.

We’ve built legal courses, M&A deals, and joint ventures backed by AI systems.

Now, we’re looking for lawyers like you - who can teach the law and serve the public through Legal Hotlines and AI-powered Courses.

We fund the ads. We host the hotline. We bring the audience.

You offer pro bono guidance - no hard sales, just real help.

Some will hire you. Many will remember you. All will benefit.

Together, we can build a powerful, AI-driven pro bono system - funded by grants, designed for impact, and built to serve for decades.

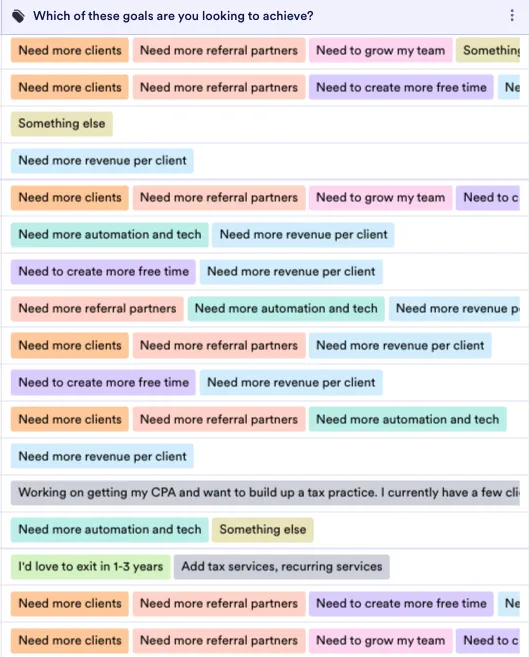

After all - the stats speak the truth - the picture shows what other solo law firms owners are also looking for - it's more or less the same set of bottom lines.

More clients.

More revenue pre client.

And more referral partners.

We can show you how to unlock all three of those, and the other ones on the list, through the incorporate of a Nonprofit & Tax Law Arm by partnering with us.

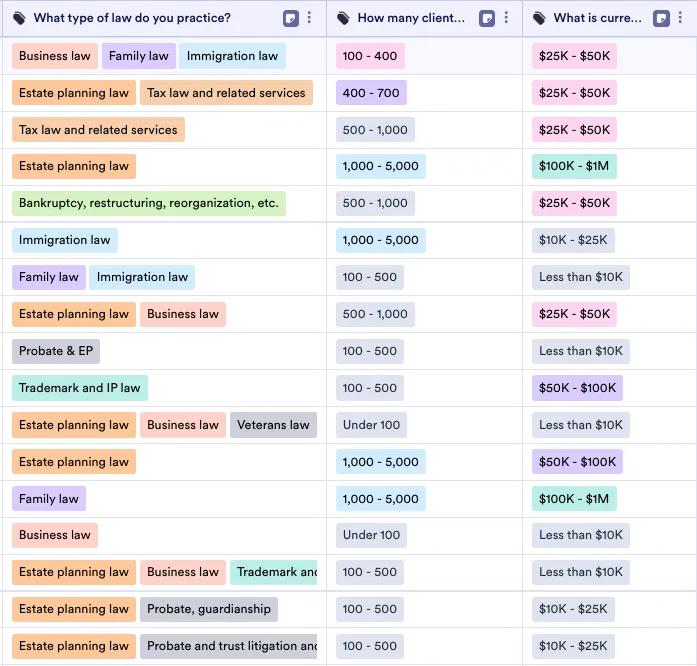

Here are some more stats from law firm owners that I met in Facebook & LinkedIn groups

MARKETERS LIE. NUMBER DON'T.

The Solo Law Firm Reality: The stats reveal that:

Close to 50% of solo law firms are grossing less than $300,000 a year.

30% have hit the $25K-$50K/month mark.

10% are grossing $50-$100K and 10% over $100K/m.

The Financial Picture (After Expenses & Taxes): 30-50% operating expenses and taxes. Profits are roughly 30-50%.

Firm 1: $25,000/m x 50% = $12,000 - $5,000 (personal expenses) = $7k-$8k a month in "true post-expense, post-tax savings" = $100,000/year

Firm 2: $60,000/m x 50% - personal expenses = $20K/month in savings x 12 = $250,000/year

Firm 3: $200K/m x 50% = $100K - $10K personal = $90K/m = $1m in savings

Does that depict your reality? Are your margins lower or higher?

Are your numbers matching up? Are you saving $100,000 - $250,000/year or more?

What's going to change going forward?

More clients? More revenue per client? More revenue lines?

Are you willing to try high-end business-estate-nonprofit-tax strategic planning & enter a strategic consulting oriented way of practicing and offering legal work?

Take my legal and tax offers and see if you can switch things up this year.

No billable hours

No court work

No chasing clients

Services range from $20,000 - $100,000 per case based on what we offer

Most cases have a recurring model after year 2 and aligns our work with CPAs and advisors who represent the client

You can test it out without risk - we'll build the site, place the content, create the intake forms, and handle everything else

If a person converts, we share a commission with you - 10-20% - fairly passive on your end

There's a $5K deposit to ensure you're not wasting my time or going to steal my ideas

If we cannot convert a single client in 3-months - we'll be happy to give you a 100% refund - no questions asked

HOW TO TEST OUT OUR NONPROFIT AND TAX INTEGRATED SERVICES:

How we typically partner with law, tax, and finance professionals:

Add a nonprofit and tax strategy page to your website that contains our philanthropic tax strategy services

We'll build the page, customize it to your brand, and create a JV message that aligns seamlessly

We'll provide content that you can use to promote these new offerings to old and new clients

It's hands-off from there: We'll handle the intake, assessment, education, conversions, and delivery

One option is to treat it as a stand-alone revenue stream, unrelated to your practice - collect a referral fee from us when we close a deal.

Another option is to integrate nonprofits & foundations as an "premium upsell" to your offerings - tax strategies align with almost every legal niche.

There is typically $20,000 - $100,000 worth of "missed revenue" per client, on average, and more in complex cases - already in your database

Additionally - Tap into new markets using our insights and experience - don't miss revenue, lose control of clients, and end the scope with a one-time $2K-$5K offer.

WE WOULD LOVE TO PROMOTE YOUR LAW FIRM AS WELL

You have already established:

A trusted client base

Deep experience in your field

A willingness to collaborate

An open mind to new opportunities

We don’t need you to be a tax and nonprofit integration expert.

We're not looking to become trademark, patent, DUI, Immigration, or litigation experts either!

We don’t need you to build new infrastructure.

We need you to bring what you already do best -

and let us help you unlock everything you haven’t tapped yet.

Here are the 3 options that we offer in a joint venture format:

Nonprofit & Tax Law Firm In A Box:

A bolt-on website offering our services to your clients and customers - we'll handle the delivery and pay a commission to you.

Legal Hotline:

An AI-powered, grant-funded pro bono hotline that we'll create with YOUR LEGAL SERVICES (DUI, Criminal, Employment, Personal Injury, Family, Real Estate, Estate Planning, M&A, Intellectual Property, Trademark, and other legal niches - we'll run ads and promote your hotline, you delivery the services and pay us a small commission or referral fee

AI-Powered Legal Education Centers:

We'll build a legal education center, secure funding, structure the courses and programs, and manage the advertising and growth of the entire "mini-university" that offers a range of legal and tax educational hotlines and courses

LAW FIRM IN A BOX

VERTICAL EXPANSION

Start by offering this to your old clients - $0 required!

LEGAL HOTLINE

HORIZONTAL EXPANSION

You already have the "marketplace" of buyers.

AI POWERED LEGAL VENTURES

LAW, TECH, AND PHILANTHROPY

Offer a strategic perspective that others have overlooked.

Press play to watch my TEDx On This Topic

Other platforms where we have shared the double bottom line formula

Leverage Both Sides Of The Tax Code & Help Your Clients Do The Same

Offer Boutique Tax & Nonprofit Solutions To High-Income Earners And Multi-Millionaires Who Are Looking For People Like Us. We create joint ventures with law, tax, and financial professionals looking to boost revenue, attract high-net-worth clients, and offer a range of highly impactful and powerful strategies that are over 100 years old and used by virtually every billionaire and wealthy family - that's where we found a lot of these "secrets" that are hidden in plain sight

Recapture Missed Revenue From Cases

Offer nonprofit and foundation work to your network of followers, cold leads, and even old clients in your database - recapturing missed revenue.

You already have the "marketplace" of buyers.

Boost Earnings & Profits Per Case

Imagine adding another $5,000, $15,000, or $40,000 per customer - old customers and new ones, boosting your overall "earnings per deal".

Start by offering this to your old clients - $0 required!

Increase Value & Bridge "Hidden" Gaps

Boost value to clients by offering nonprofits and foundations, especially from as a business expansion, estate protection, or tax reduction tool.

Offer a strategic perspective that others have overlooked.

Expand Vertically Or Horizontally

Leverage the power of the tax code to pierce and penetrate the market in a completely different way, allowing expansion in diverse ways.

The flexibility of the tax code allows you to diversfy.

Offer Legal Consulting Work That Is Flexible

Nonprofit, foundation, and tax consulting is very flexible and can be applied to hundreds of different scenarios - perhaps even thousands.

Consulting work is quite different from law firm work.

Build New Referral Streams With Others

Bypass some of the traditional partnership, solicitation, and referral restrictions on your law firm by adding a nonprofit arm or a consulting firm to the mix.

Start a legal education nonprofit and form JVs.

Gain Goodwill, Trust, And Loyalty

Stand out as a lawyer and law firm that serves society and advances humanity, not just focused on closing deals, billing hours, and profits.

Operating or serving nonprofits is noble and respectable work.

Leverage Foundations For Tax Savings

Private foundations are one of the most powerful vehicles in the tax code that offer layers and layers and layers of tax benefits.

Structuring a foundation can unlock a whole new market.

Attorney, Educator, & Philanthropist

Stand-out in your marketplace as an innovator, educator, impact investor, purpose-driven leader, and philanthropist + Attorney.

How many of your competitors are leveraging this angle?

Become A Double Bottom-Line Law Firm

Explore The Power Of Nonprofits And Foundations™

Good For Business, Good For Society™

Schedule A Chat With Sid Peddinti™